Freer home sales market draws Californians to Texas

By Wayne Lusvardi

What draws working and middle class Californians to states like Texas is mostly a freer home sales market, which brings lower prices. A zero state income tax rate and lower business tax rates that provide incentives for job creation also matter, but to a lesser extent.

The Texas advantage occurs even though its property base tax rates are double or triple those in California. However, although the tax rates are higher, because home prices are lower, the rates are applied to the lower values.

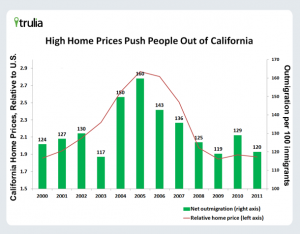

That is the conclusion of Jed Kolko, the chief economist for Trulia, an online home sales listing company. Kolko found that net California out-migration (those leaving minus those coming in) is higher for the working and middle class than it is for the wealthy. Kolko’s statistical analysis actually found that high-income households making $200,000 per year or more were holding steady in California.

Thus, the media hullabaloo about rich people fleeing California’s high income tax rates was not found, at least so far, after analyzing a large set of home price data. Businesses may be fleeing California, but high-income households are not on a net basis.

Kolko’s study found that out-migration fell when home prices fell and vice versa. According to his analysis, Californians move to states like Texas because they have a freer real estate market and more market-produced affordable housing. It’s simple Econ. 101: Greater supply reduces prices.

In California, affordable housing is erroneously thought to be something that only government produces. Actually, current median home prices in both California and Texas are nearly what they were in August 2008 before the Mortgage Meltdown and Bank Panic.

Texas still cheaper even with higher electric costs

Expanding on Kolko’s findings, this writer additionally found that net out-migration from California to Texas is occurring despite higher property tax rates and electricity costs in Texas. Because property taxes are higher in Texas, home prices are also lower.

Total housing costs — mortgage payment plus property taxes plus electricity bills — are 20 percent lower in Texas than California. That happens even though average electricity bills in Texas are $49.10 per month higher than in California. The Golden State’s lower cost is mainly due to more moderate weather and energy efficiency policies.

Total Housing Cost Comparison

| California | Texas | |

| Median home price per square foot, 2012 | $229,000 | $84,000 |

| Unemployment rate | 9.8% | 6.1% |

| Total state + local tax burden percent of income, 2010 | 11.04% | 8.96% |

| Household median income | $61,632 | $50,920 |

| Median home price Dec. 2012 (U.S. Census Bureau) | $299,000 | $175,000 |

| Average mortgage interest rate per Bankrate.com | 3.79% | 3.79% |

| Down payment | 20% ($59,800) | 20% ($35,000) |

| Monthly mortgage payment 30 years | $1,113/month | $651/month |

| Base property tax rate | 1% | 2% to 3% |

| Median property tax/year | $2,900 | $3,500 to $5,250 |

| Total mortgage payment + property tax load/year | $16,256 | $12,187 |

| Median Multiple(Median Home Price divided by Median Income) | 4.85 | 3.44 |

| Median Home Price Aug. 2008 | $301,000 | $170,000 |

| Average electricity bill per month | $81.10/month$973.20/year | $147.32$1,767/year |

| Average electricity consumption in kilowatt hours | 1,130 | 587 |

Texas has something that draws working and middle class residents from California. It is lower total housing expenses, not just no state income tax. And this is primarily due to a freer real estate market in Texas that is unburdened by growth controls, environmental restrictions, rent controls open space requirements and historic preservation laws.

Related Articles

Wall Street Journal too nervous about bullet-train ruling

Over the weekend, the Wall Street Journal’s editorial page continued its excellent coverage of California issues with an editorial (behind

High-Speed Rail Crashes Into Legislature

APRIL 27, 2011 By KATY GRIMES The costs and the legislation for the California High-Speed Rail Authority keep speeding toward

Gov. Brown faces high-speed rail hurdles

Republicans’ triumph last week in the U.S. Congress already is rippling across the country. Does that bother Gov. Jerry Brown