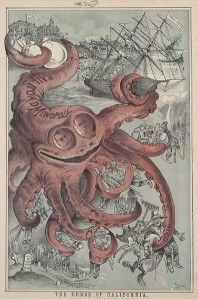

CalPERS seeks to be new California ‘Octopus’

By Wayne Lusvardi

In 1901, Frank Norris wrote a novel, “The Octopus: A Story of California.” The book became famous for its description of the monopolistic Southern and Pacific Railroad that dominated California a century ago.

Fast-forward to 2012 and the bankrupt city of San Bernardino, where the California Public Employees Retirement Fund is trying to become a new Octopus.

CalPERS asserts in bankruptcy court that it is a sovereign government agency that has police powers, the power of eminent domain and the power of taxation. Police powers are the right of governments to enforce laws and regulations to protect public safety, health and welfare. Eminent domain is the power to seize property for public use, while paying just compensation to the owners. The power of taxation means the constitutionally granted power of government to use coercive powers to impose and collect taxes.

CalPERS contends it is “an arm of the state” that is immune from the jurisdiction of the bankruptcy court. Thus, it asserts that the bankruptcy court cannot halt CalPERS from exerting its supreme right to the general funds of the city to meet its public-pension fund payments. When the City of San Bernardino filed for bankruptcy, it stopped making pension payments to CalPERS. But CalPERS believes that it has police powers to protect government pensions as a new entitlement above even the duty of local government to protect its citizens from crime, fires and emergencies.

The Wall Street Journal reported: “If CalPERS has police power and sovereign rights, it could also seize private property or assess a special pension fee on taxpayers” — no matter that Proposition 13 requires a vote for any increase in taxes. The Wall Street Journal cites the Fifth Circuit Court of Appeals, which ruled in 1940 that there is no preferential treatment for the state as a creditor. CalPERS asserts it can seize assets and leave the cash-strapped city of San Bernardino without money for essential public services such as police and fire protection.

CalPERS and underwater mortgage eminent domain

CalPERS often throws its weight around by using what is called “the CalPERS effect” to influence investment markets. It may not have monopoly power, but it has market power. This was described in a 2009 paper by Wilshire Associates Inc.:

“The California Public Employees’ Retirement System … has been a leading activist in the modern corporate governance movement since its beginnings in the mid-1980s. Over time, CalPERS gradually shifted its focus from more technical issues related to corporate control to fundamental issues of long-term corporate performance.”

The County of San Bernardino has recently retained Mortgage Resolution Partners to explore using eminent domain to condemn “underwater mortgages” as a way to bail out to several cash-strapped cities in the county. If over-mortgaged properties can be purged from lenders’ books, then CalPERS hopes the housing market will recover and tax coffers will refill and bail out the city and county pension funds.

Legal experts are doubtful that eminent domain can be used to take mortgages from lenders at less than full value, then pass the expected savings on to property owners with over-mortgaged properties. Nonetheless, CalPERS believes it can trump even the courts, despite the checks and balances of the three branches of government: executive, legislative and judicial.

Executive agency

In reality, CalPERS is an agency under the executive branch of California government, with an unelected board that is not directly accountable to the public. Its board of directors is partly elected by CalPERS retirees. Other board members are appointed by the governor and the Legislature. Also on the board are the state treasurer, controller, director of the Department of Personnel Administration and a delegate from the state Personnel Board.

There is no representation on its board to assure taxation with proportional representation or representation by taxpayer watchdog organizations.

What success CalPERS’ claims to sovereignty may have with a cash-strapped state court system that has a vested interest in any bailout of the state pension fund remains to be seen.

The Wall Street Journal calls CalPERS’ assertion of unlimited powers a “ploy.” Real octopus animals squirt an “ink” that serves to keep themselves hidden or as a decoy from predators. Expect some of the same from CalPERS.

Related Articles

Study Says Public Pay Out Of Line

OCT. 5, 2010 A new California think tank is releasing a new study Wednesday on reforming public employee pay and

Japan Quake Shaking CA Economy

MARCH 15, 2011 BY JOHN SEILER In the long run, California’s economy probably will not be greatly affected by the

CA GOP Shouldn't 'Go Wobbly' on Taxes

JUNE 16, 2011 I met Margaret Thatcher, the former British Prime Minister, back in 1993 on a visit she made